Part of closing is paying a number of fees to various service providers (including your lender). If you want mold, radon or a pest inspection, you can usually add those testing services for an additional fee.Īfter you move on to the finalizing the contract and loan paperwork, you’ll set a closing date with your lender. A typical home inspection includes an assessment of the roof, attic, plumbing, electric, appliances, heating and cooling, foundations, walls and ceilings. Most home inspections in Hawaii average between $227 to $400, while the cost may be less for a condo or smaller home. While not a mandatory step, it’s what smart homebuyers do to ensure that the house doesn’t have any major issues. One of the first is a home inspection for the property you plan to purchase. Prior to starting your monthly mortgage payments, property tax payments and homeowners insurance, you’ll need to pay a number of costs during the home-buying process. Costs to Expect When Buying a Home in Hawaii Financial advisors can also help with investing and financial plans, including retirement, taxes, insurance and more, to make sure you are preparing for the future. Hawaii’s Insurance Division has a Consumer’s Guide to Homeowners Insurance that explains the different types of homeowner policies.Ī financial advisor can help you understand how homeownership fits into your overall financial goals. Normal homeowners insurance doesn’t cover flood or earthquake damage, so if you want to insure your home against that type of damage, you can purchase it separately. The last major hurricane to hit the islands prior to Iniki was Hurricane Dot back in 1959. The last hurricane to cause significant damage to the Aloha State was 1992’s Hurricane Iniki which caused an estimated $1.8 billion in damage mostly to the island of Kauai, according to AccuWeather. In fact, Hawaii doesn’t even make it on any of the Insurance Information Institute’s hurricane damage or at-risk states. However, contrary to what you might assume, hurricanes aren’t as high a risk in this state than other areas in the U.S. Obviously, being an archipelago, there comes inherent homeowner risks. In Hawaii, the average annual premium is $440, according to data. However, applicable exemptions are applied to this number prior to tax rates.Īnother cost to consider is homeowners insurance. Your taxes will be based on the assessed value, which is equal to market value. If you have an issue with your home’s assessment, you can appeal with your local tax board. Your home will be appraised once a year, and after you’ll receive your property’s assessed value in the mail. So if you plan on calling the Aloha State your year-round home, you’ll save some money on property taxes.Įach county in Hawaii administers and collects property tax.

One of the reasons is exemptions for owner-occupied residences. Hawaii has the lowest property tax rates in the nation, with an average effective rate of 0.27%. Principal: The principal is the amount you borrow before any fees or accrued interest are factored in.While your mortgage payment may be high due to Hawaii’s hefty real estate prices, you won’t be burdened with high property taxes on top of it.Your loan’s principal, fees, and any interest will be split into payments over the course of the loan’s repayment term.

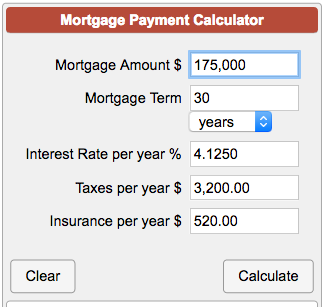

Repayment term: The repayment term of a loan is the number of months or years it will take for you to pay off your loan.You can use Bankrate’s APR calculator to get a sense of how your APR may impact your monthly payments. APR: The APR on your loan is the annual percentage rate, or cost per year to borrow, which includes interest and other fees.This rate is charged on the principal amount you borrow. Interest rate: An interest rate is the cost you are charged for borrowing money.When taking out any loan, it’s important to understand these four factors: Common types of unsecured loans include credit cards and student loans. Unsecured loans don’t require collateral, though failure to pay them may result in a poor credit score or the borrower being sent to a collections agency. In exchange, the rates and terms are usually more competitive than for unsecured loans. Common examples of secured loans include mortgages and auto loans, which enable the lender to foreclose on your property in the event of non-payment. Secured loans require an asset as collateral while unsecured loans do not.

0 kommentar(er)

0 kommentar(er)